Mélange #5

Various Topics That Caught My Attention in the Week Ending October 7th, 2022

Economic Highlights & Lowlights

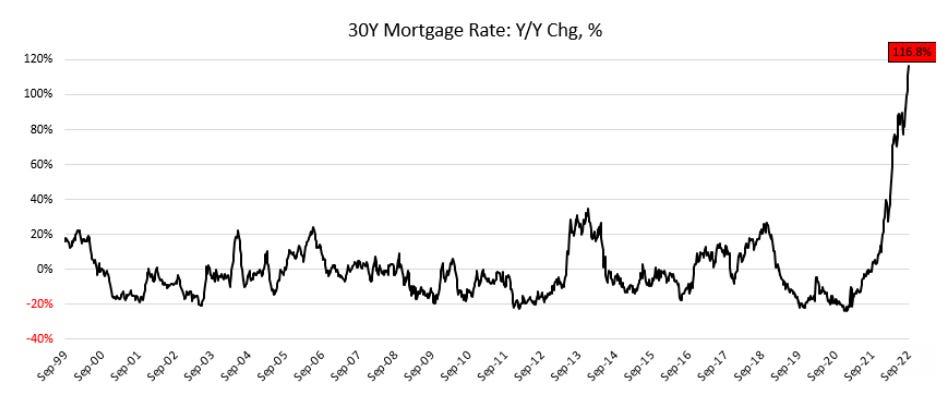

— 30-year Fixed Rate Mortgages are at 6.66% v. 6.70% last week

— Consumer Inflation Expectation is 4.7% in 1 year and 2.7% in 5-10 years.

— Factory Orders were flat at 0.0% v. -1.0% in Aug

▼ Job Openings fell -11% to 10.05 million in Sep from 11.17 million in Aug

▼ Non-Farm Payrolls were up 263K in Sep, down 17% from 315K added in Aug

▼ ISM Manufacturing PMI fell to 50.9 in Sep from 52.8 in Aug (<50 = contraction)

— ISM Services PMI fell to 56.7 from 56.9 in Aug

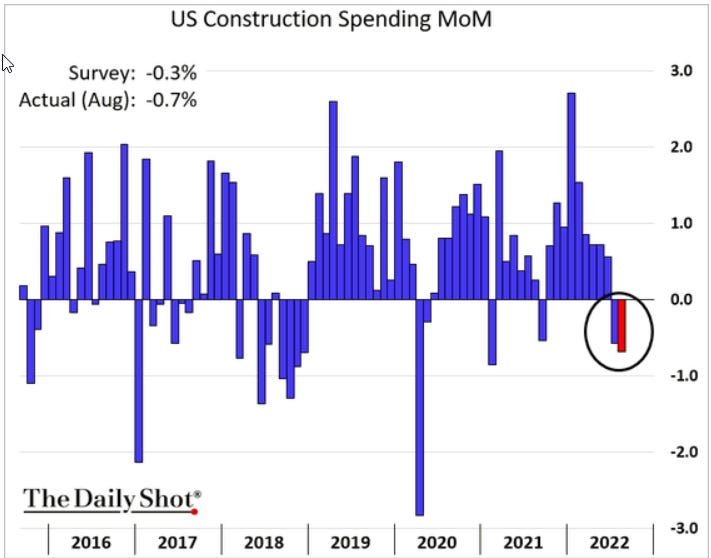

▼ Construction Spending down -0.7% m/m v. -0.6% in Aug

▼ Crude Oil Inventories down -1.4M barrels vs -0.2M in Aug

▲ Natural Gas Inventory rose to 129B cu. meters from 103B in Aug

▼ Unemployment Claims rose to 219K v. 190K in Aug

— Unemployment Rate dropped to 3.5% from 3.7% in Aug

▼▼ Job Cuts announcements rose +67.6% y/y from +30.3% in Aug

— Average Hourly Earnings rose +0.3% m/m, same as +0.3% in Aug

▲ Wholesale Inventories rose +1.3% m/m, same as +1.3% in Aug

▼▼ Consumer Credit rose to $32.2B in Sep, up 23% from $26.1B in Aug

Notable Quotes Without Snarky Comments (It’s Not Easy!)

The World Speaks

Chief German Energy Regulator: “We will struggle to avoid a gas emergency this winter without at least 20% savings in private households, businesses, and industries.”

Belarus President Alexander Lukashenko: “From October 6, all price increases are forbidden. Forbidden! As of today, not tomorrow!”

Swiss National Bank Chairman Thomas Jordan: “The Swiss National Bank (SNB) will not accept Swiss inflation above its target of 0-2%.”

International Energy Agency (IEA) Executive Director Birol: “This winter will be difficult, but the next winter will be very difficult.”

The Government Speaks

Joe Biden: “[N]o one should be in jail just for using or possessing marijuana …. I’m pardoning all prior offenses of simple marijuana possession.”

Joe Biden, opening line of speech at Volvo plant in Maryland: “Let me start off with two words: made in America.”

The Fed Speaks

Waller: “It is not the Fed’s responsibility to tackle the issues of other countries.”

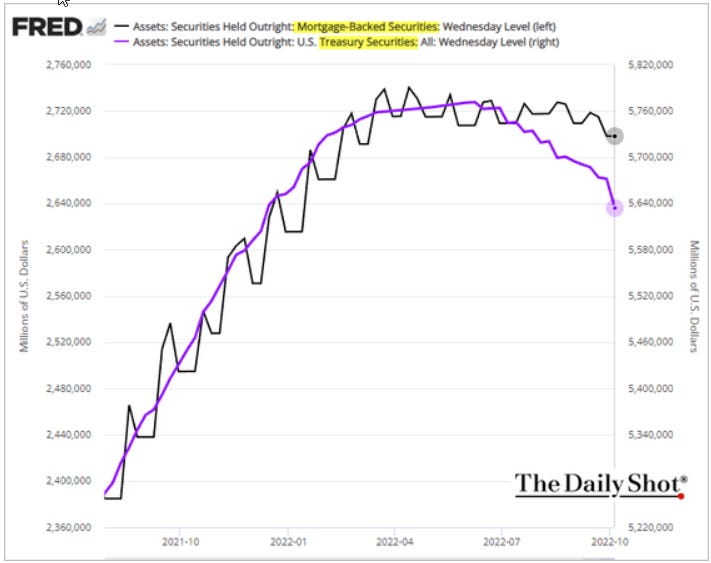

Evans: “I believe the balance sheet will be completely reduced within three years.”

Kashkari: “This feels like stagflation, but it’s a transition period. I’m very confident we’ll get through this moment. This moment might be a year or two.”

The Analysts Speak

Doomberg (the Green Chicken): “We are not led by serious people.”

Julian Brigden (MI2 Partners): “[I]n the 1970’s, the pricing power of the unions underpinned inflation. Now I’m concerned the Federal Reserve’s biggest enemy [in reining in inflation] is the US corporate sector, who are raising prices to maintain margins. This is going to be a hell of a fight.” The problem in the 1970s was wage growth; today it is the cost of input materials.

Jim Cramer (CNBC): [Posted on Twitter - so filthy I can’t quote it here.] Sent his regards to the creators of a new ETF that sells every stock Cramer recommends buying, and its performance is beating him ($SJIM).

Peter Zeihan citing Ryan Grim: “If I were Biden, I’d tell MBS the cost of maintenance of their [US-supplied] bombers just went up to $1 billion a day.” ‘MBS’ is Mohammed bin Salman, Crown Prince and Prime Minister of Saudi Arabia — Biden asked him to pump more oil; he decided to pump less.

The Rude Awakening: “It’s important to understand that America’s light, sweet crude isn’t the be-all and end-all. Light, sweet crude produces gasoline, diesel, and aviation fuels. Canada’s (and Russia’s) heavy crude provides feedstock for plastics, petrochemicals, other fuels, and road surfacing. Heavy oil can also be refined into transportation fuels. You need both, folks. And America only has one of them in abundance.”

Tommy Thornton tweeted good news on his stock positions: “[M]y shorts are dropping like wet socks on a chicken.”

Samantha LaDuc (@SamanthaLaDuc): “Unless interest rates fall sharply in the coming months, the interest expense on Public Debt will soon surpass $1 trillion on an annual basis and become the largest line item in the budget.”

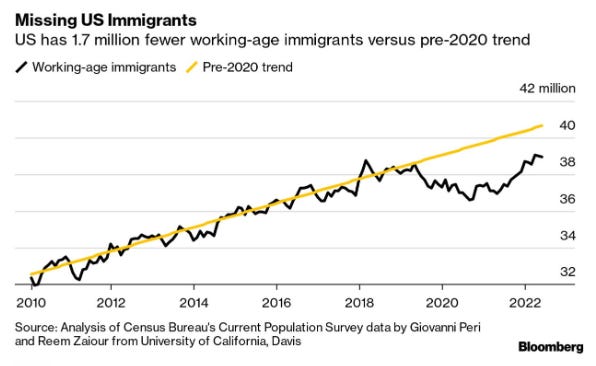

Missing Immigrants

Bloomberg reports that US immigration is rising but still not closing the labor gaps in industries reliant on foreigners like construction, hospitality, and services. Applications are down to just 80% of pre-Covid levels. One reason is that job opportunities at home have improved for them.

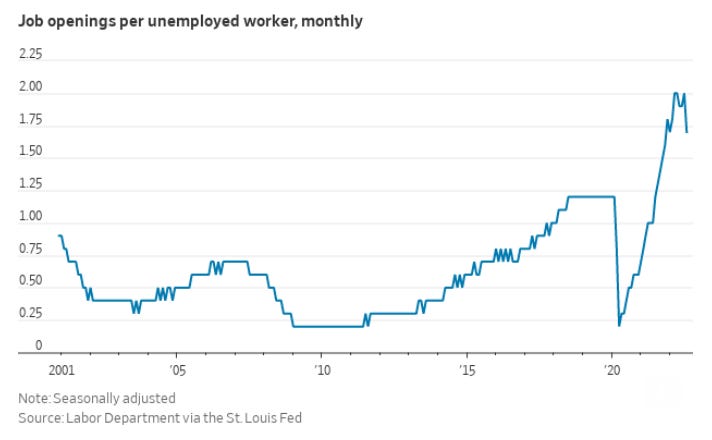

US Job Market is Tightening

Job openings fell 10% m/m and layoffs rose in August, adding to signs the labor market started cooling off at the end of the summer.

NASA’s CAPSTONE Mission Was Saved

CAPSTONE CubeSat engineers regained control of the spacecraft after four frightening weeks by remotely fixing a stuck valve on one of its thrusters. It is on a 4-month trip to the Moon where it will be inserted into a gravitationally stable “halo” orbit. This is the type of orbit the future Artemis missions will use to put a permanently habitable space station named Gateway in orbit around the Moon. CAPSTONE is scoping out the orbit - we’ve never done this one before.

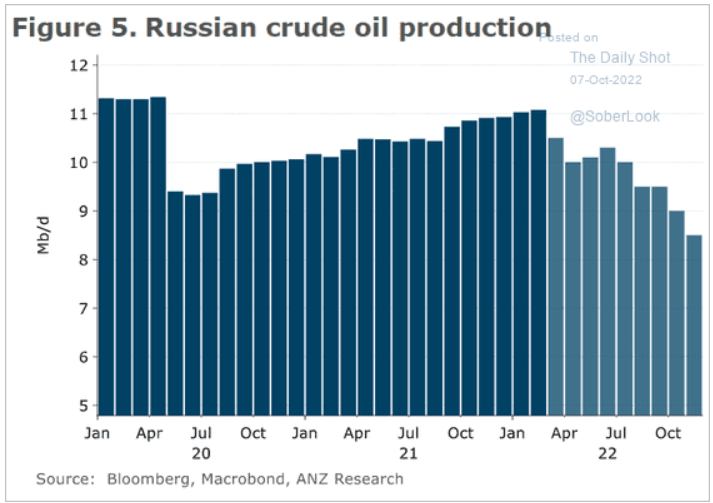

Russian Oil Production Losses are Confirmed

Several sources have now reported that Russian oil production has indeed fallen and is forecast to continue its steady decline. This is one reason not to panic over the recent OPEC+ announcement of a 2 Mbpd cut — Russia alone has already lost 2.4 Mbpd of capacity. Saudi Arabia is behind on its production, too. Mohammed bin Salman’s announcement about cuts was political, not real, and was intended to publicly show Washington’s power has diminished and that Saudi ties with Russia are strengthening.

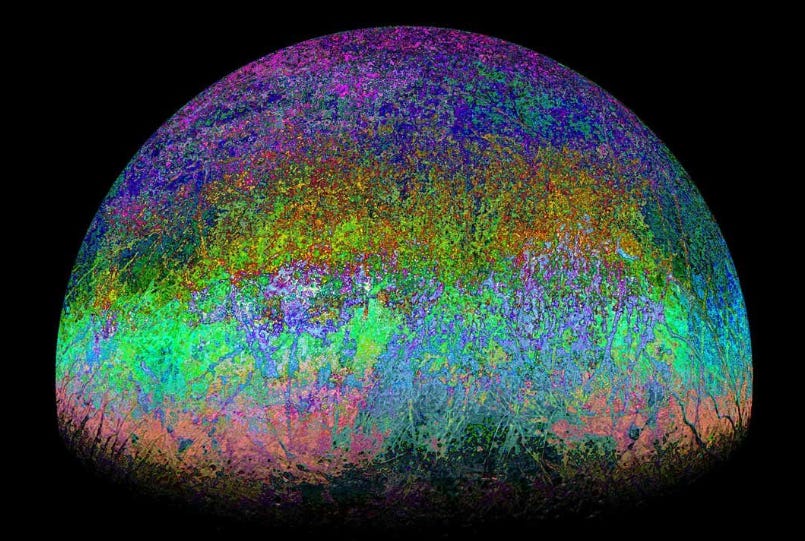

Citizen Scientists Improve Space Images

NASA, ESA, and other space agencies take incredible images in space. For years, they have been making the full resolution RAW image files available for anyone to download. The picture below shows why. “Citizen scientists” have incredible image processing and data visualization skills, and the scientific community has opened itself up to using them. Giving everyone access to master data lets them apply their own special skills and techniques. Björn Jónsson saw Juno’s master image of Europa (on the left) and used his own special algorithms to enhance color and contrast to produce and share the image on the right.

The old habit of hoarding data will never completely leave science, but we see now the benefit of letting some of it loose in the wild and seeing what comes back. Science is collaborative and bringing to bear all of the talent in the world is its future.

Fish Tales

Pandemonium broke out at a professional fishing tournament when the winner of over $300K that day was caught cheating. He scored the heaviest catch by stuffing large lead weights down the fish’ throats. Seriously, dude? Cheating at fishing?

And this just in: The reigning world chess grandmaster was also indicted this week for cheating. Funny that they both stink just as badly.

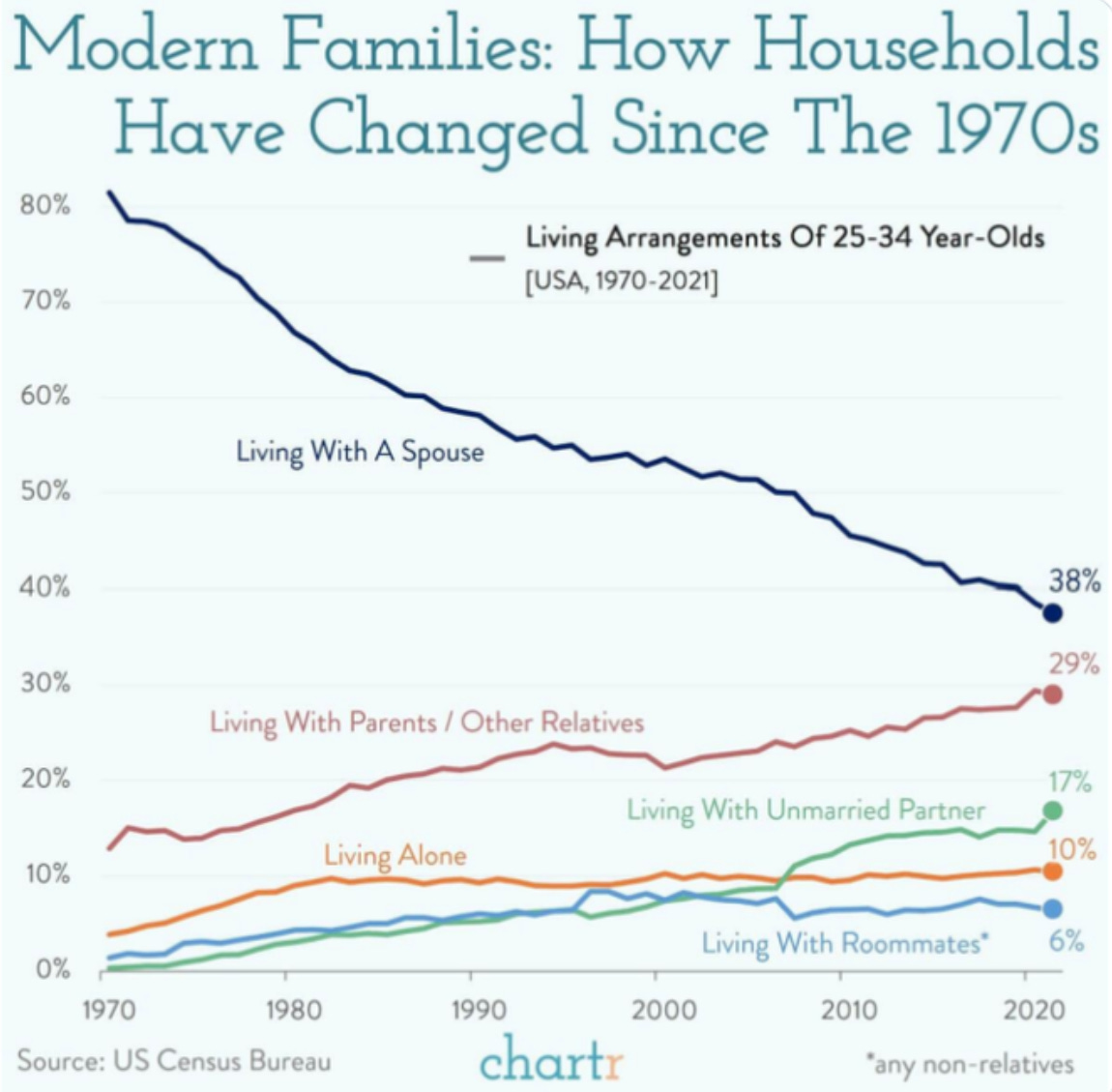

Living Arrangements

Times have certainly changed …

Gratuities

Thank you to the Libertarian Party of Nevada for this great idea to help out the people who take care of us. I won’t comment beyond saying that I have done it and that it is perfectly legal under gift tax laws.

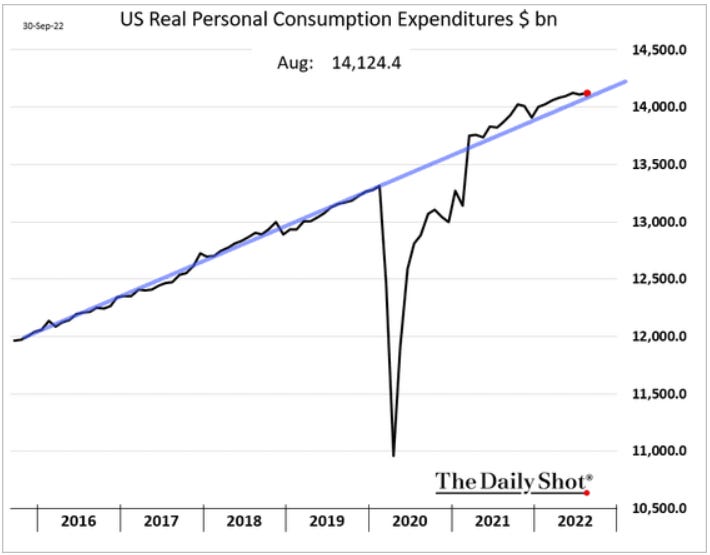

Consumers Are Spending More …

The Fed’s efforts to destroy demand are not working yet. Americans continue to increase their spending. Spending growth is slightly ahead of pre-pandemic levels.

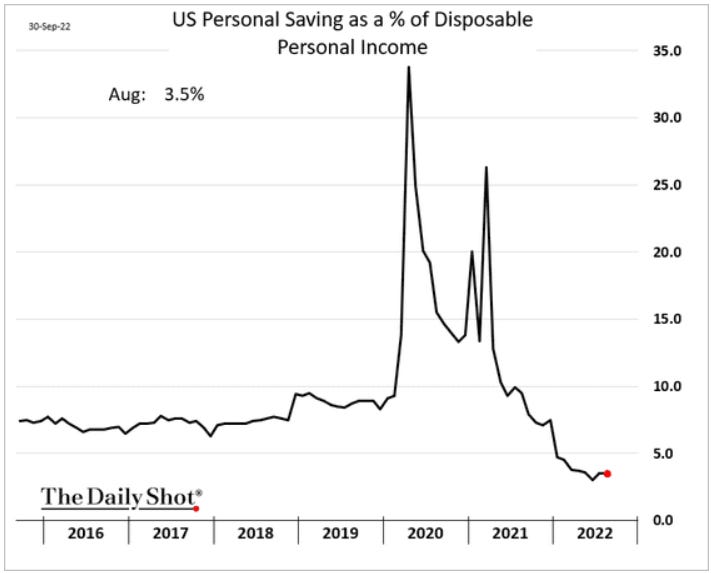

… and They’re Drawing Down Savings to Do It

As spending has gone up, Americans’ savings have gone down.

ISM Manufacturing PMI

US manufacturing is grinding toward contraction (PMI < 50). Customer inventories are growing, so it’s not surprising to see new orders and order backlogs shrinking, and with the strength of the US dollar, orders for export are contracting as well. With manufacturing slowing, net hiring has stopped with the employment index sliding to 48.7. Some good news is that prices paid for raw materials have almost stopped rising which means cost-push inflation should start to fall. Note that this is only for the US: the Eurozone PPI was up a scorching +43.3% for the year ending in August.

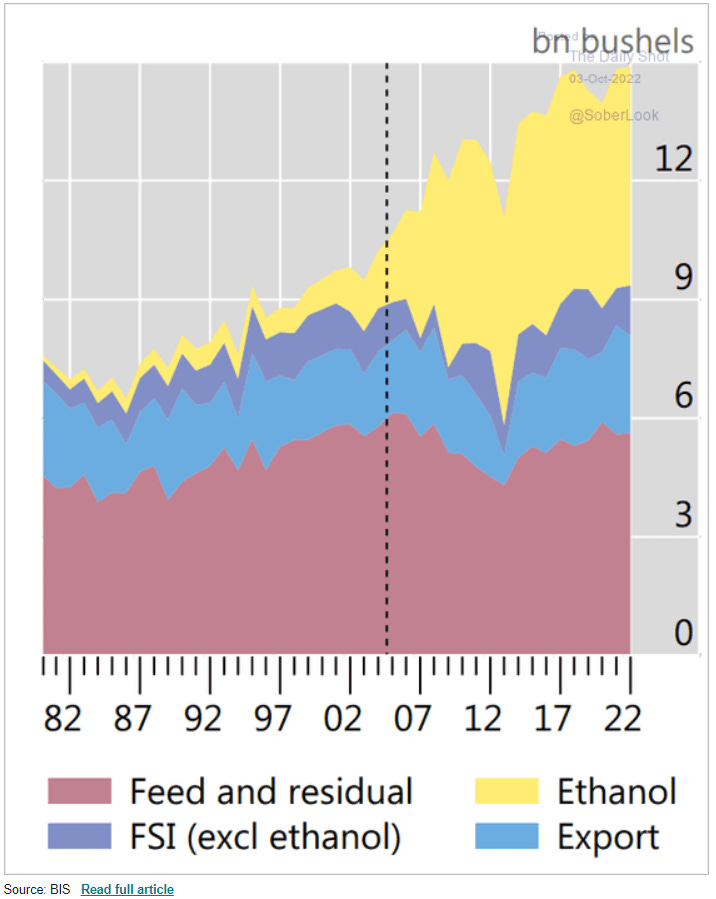

How US Corn Gets Used

We grow a lot of corn, even here in northwestern New Jersey, but it doesn’t all go to feed people. Most goes into animal feed, but more of it lately has been used for producing ethanol since the government has raised its limit as a fuel additive to 15%. Weather has been favorable, and yields have been good, but this will change in future seasons as fertilizer and pesticides have become many times more expensive. At some point, global food shortages are going to create tension over the use of corn. Our government subsidizes ethanol production, and it effectively lowers the price of gasoline at the pump, but the day is coming when the corn is needed more for food — this should reduce government subsidies but will raise gasoline prices. I’m presuming that corn for human consumption (as opposed to cattle feed) is the same as that used for ethanol - if not, then plantings will have to change.

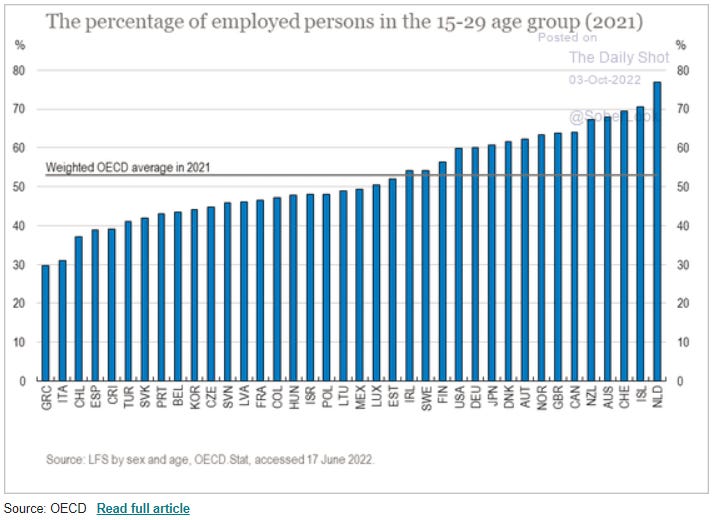

Youth Unemployment

Wages have gone up and the economy is rough, so more youth (15-29 years old) are looking to work. US youth employment at 60% is higher than many countries. High youth unemployment, especially in frontier and emerging economies, is the source of a lot of social discontent and leaves young people vulnerable to recruitment by gangs and terrorist organizations. In the US, job openings fell -11% last week, and with wealth destruction dragging retired people back into the workforce, kids might find themselves competing with their parents for jobs.

Mississippi River Traffic Halted

This is peak season for moving heartland crops south and fertilizer north, but the Mississippi River level is so low that traffic has been stopped at Memphis and Vicksburg. The Army Corps of Engineers is dredging the river to gain clearance for traffic to restart, maybe this weekend. One-way traffic will be allowed with barges loaded at only 80% of the usual tonnage and in groups 40% smaller — the reduced capacity is driving up barge rates. 5% of all freight traffic in the US, measured in ton-miles, moves on Mississippi barges instead of trucks, planes, and trains.

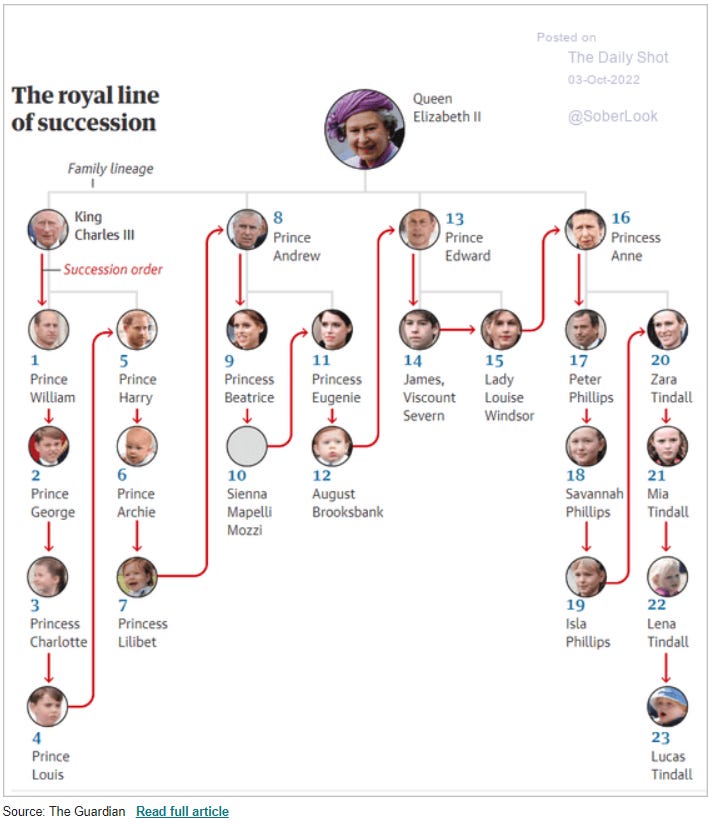

UK Royal Succession

This colonist has never been able to figure out how monarchies and parliaments work, but here’s an image that made succession crystal clear.

Construction Spending is Down

Construction spending has fallen for the second month. The drop is in residential: commercial is holding flat.

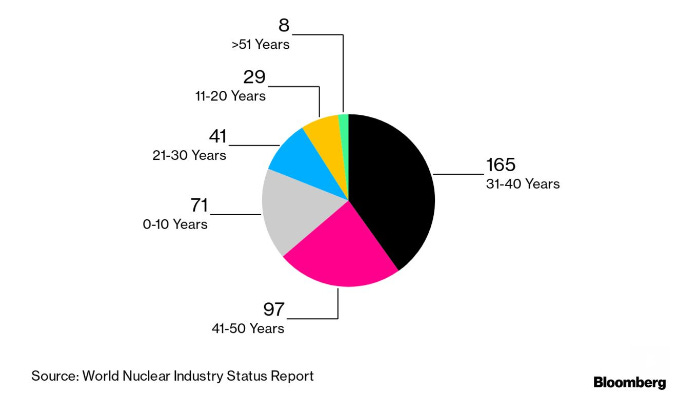

Nuclear Reactor Ages

Bloomberg America wrote about the increasing age of nuclear reactors around the world. By 2030, there will be 270 reactors 40+ years old. I was excited to see that in the last decade we’ve built more than twice as many reactors as in the decade before. I hadn’t realized that the majority of reactors are already 31+ years old — probably for the same reason my brain still thinks it’s in its 20s :-) The world’s experts are watching Ukraine’s Zaporizhzhia reactor carefully to see what we can learn about reactor safety in the middle of an active war zone. Always learning …

The Coming Boom in Housing Availability

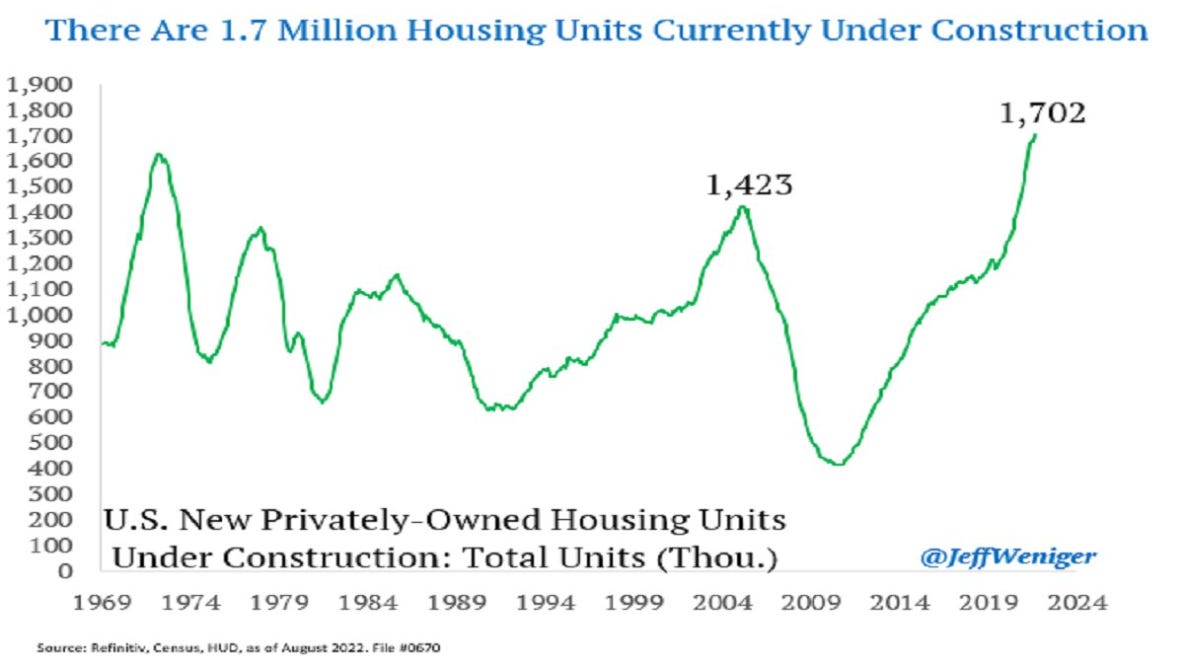

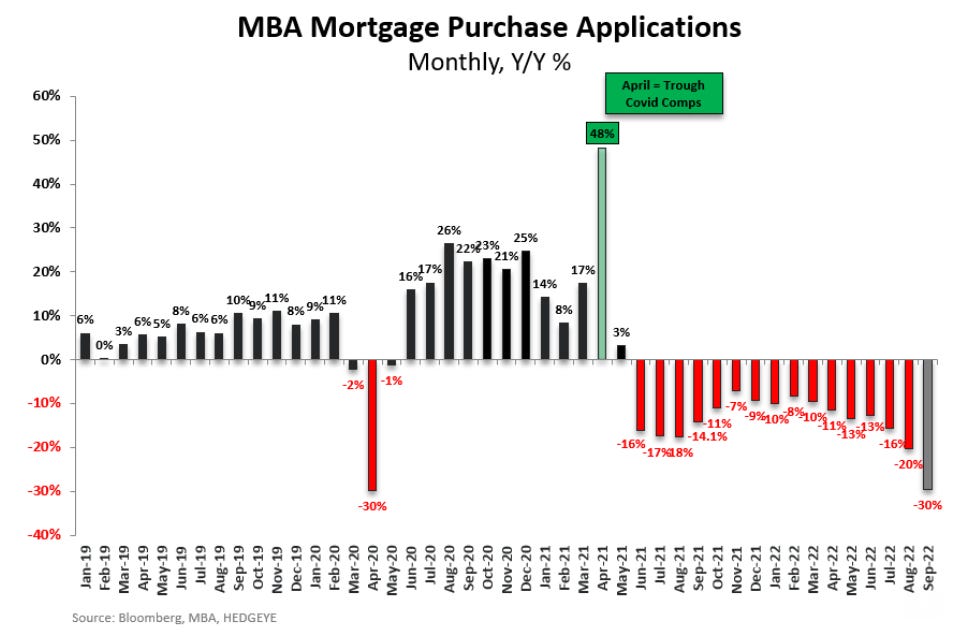

There will be 1.7 million new homes coming to market just in time for mortgage rates to hit 7% — and 87% of buyers take out mortgages. Expect homes to be on the market for longer and sell for less. The number of homes is unusually high because materials delays and a shortage of skilled labor continue.

Cannabis Rescheduling and Pardons

President Biden pardoned users and possessors of marijuana on Thursday. He also called for rescheduling it: cannabis today is ranked by the Food and Drug Administration (FDA) as bad as heroin and worse than fentanyl. It sounds simple, but there are practical obstacles for fixing this insanity.

First, criminal sentencing guidelines use marijuana as their baseline — cocaine sentences, for example, are calculated based on equivalent units of weed — so a lot of legal code needs to be changed.

Second, what should it be re-scheduled to? That’s a long process with the FDA.

Third, federal prosecutors use marijuana possession as a baseline for criminal plea deals. When a defendant is also arrested on more serious charges, busy prosecutors who think the case will take too long to build will let them plead down to marijuana possession. People imprisoned for simple possession may, in fact, have committed more serious crimes — each case will have to be reviewed.

Fed’s Balance Sheet

The Federal Reserve is now holding about $8.5 trillion in assets on their balance sheet, $2.70 trillion of MBS and $5.64 trillion of US Treasuries. Six months ago, it was $2.72 and $5.76 trillion, respectively. That’s only a $140 billion reduction — it was supposed to be $333 billion by now, but they haven’t sold any MBS. I suggested in an August post that they would not want to take the loss on selling their low-rate, long-duration MBS into a market where demand for MBS is already very low.

Important Russian Bridge Knocked Out

A section of the 12-mile-long Kerch Bridge, the only connection between Crimea and the Russian mainland, was destroyed a few hours ago by Ukraine. The bridge is a crucial route for delivering supplies to Russian troops in southern Ukraine. Several spans in both directions have been destroyed, including the railroad bridge which runs adjacent to the roadway.